- OUR PRODUCTS

- Attendance

- Leave

- Claim

- Payroll

- Appraisal

- MOBILE APP

- e-Attendance

- e-Leave

- e-Claim

- e-Payslip

- e-Profile

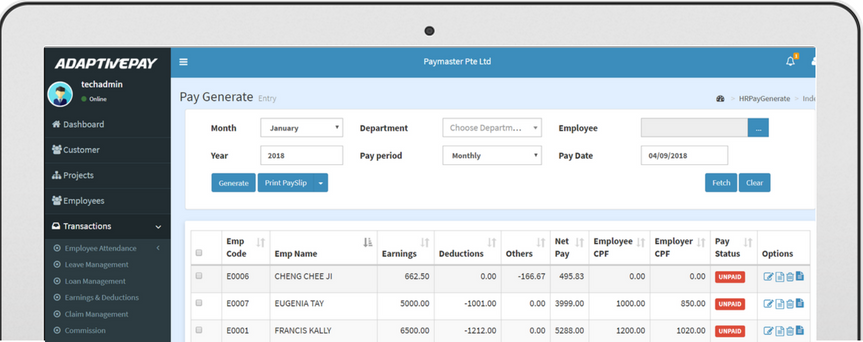

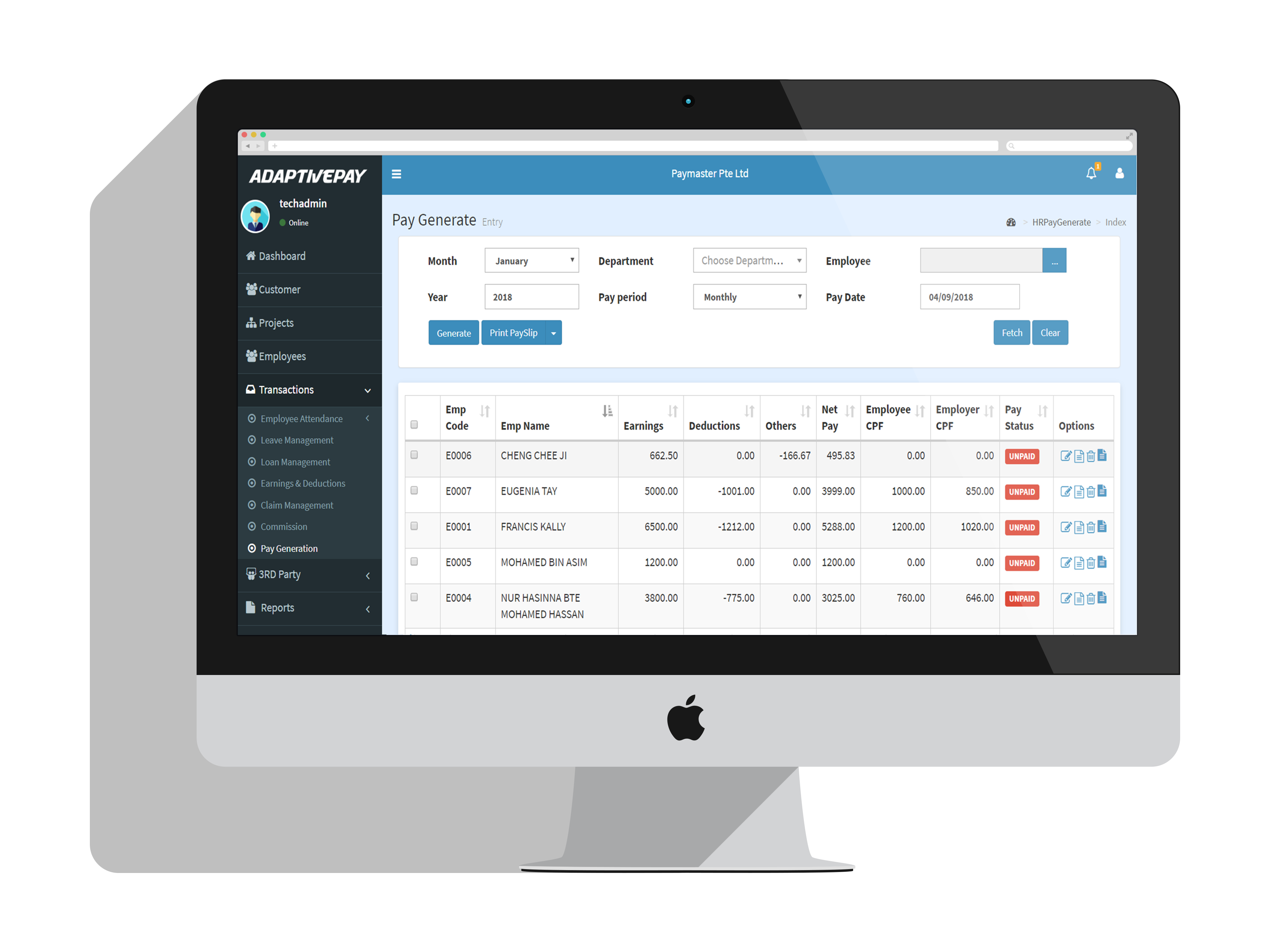

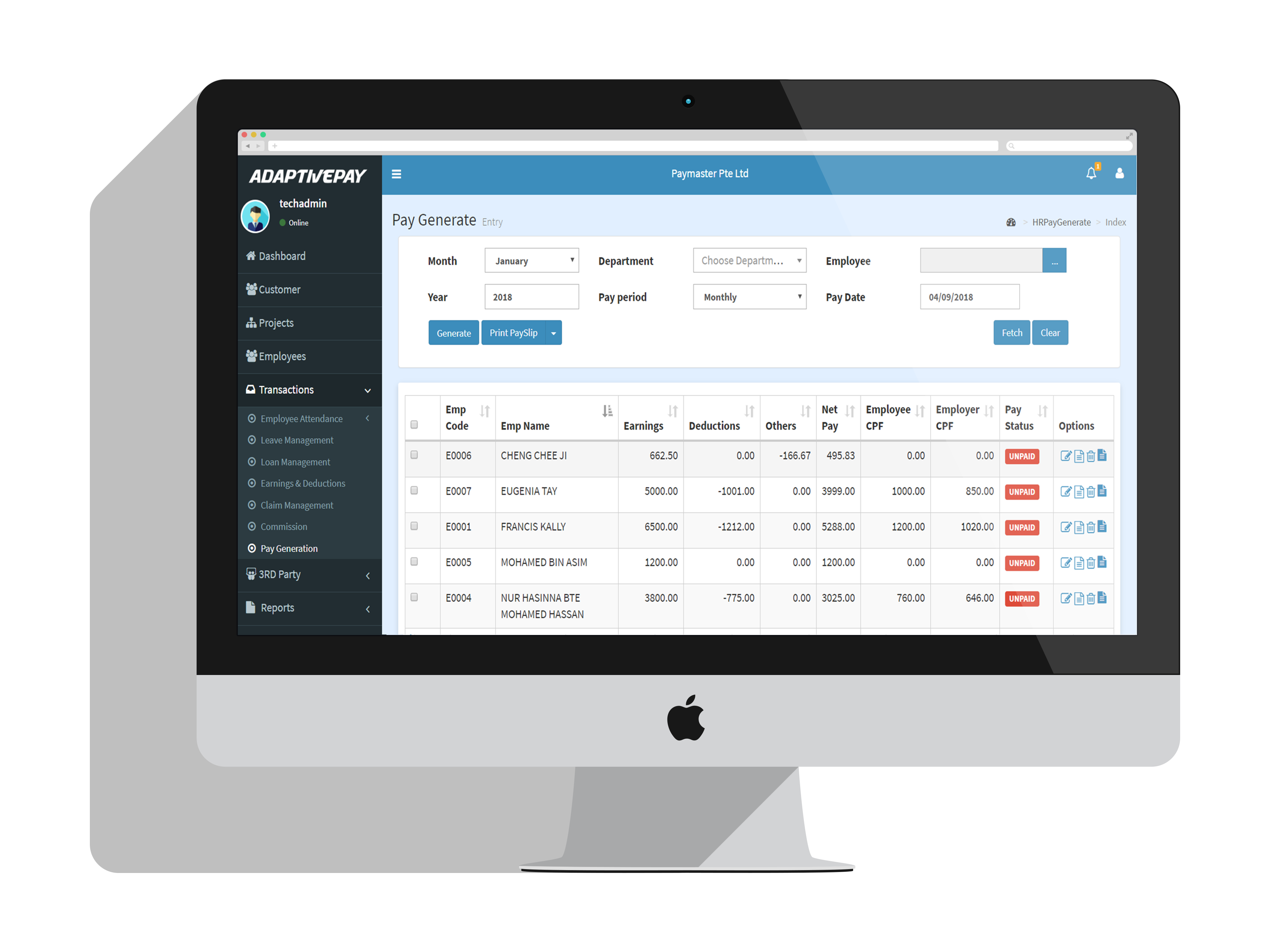

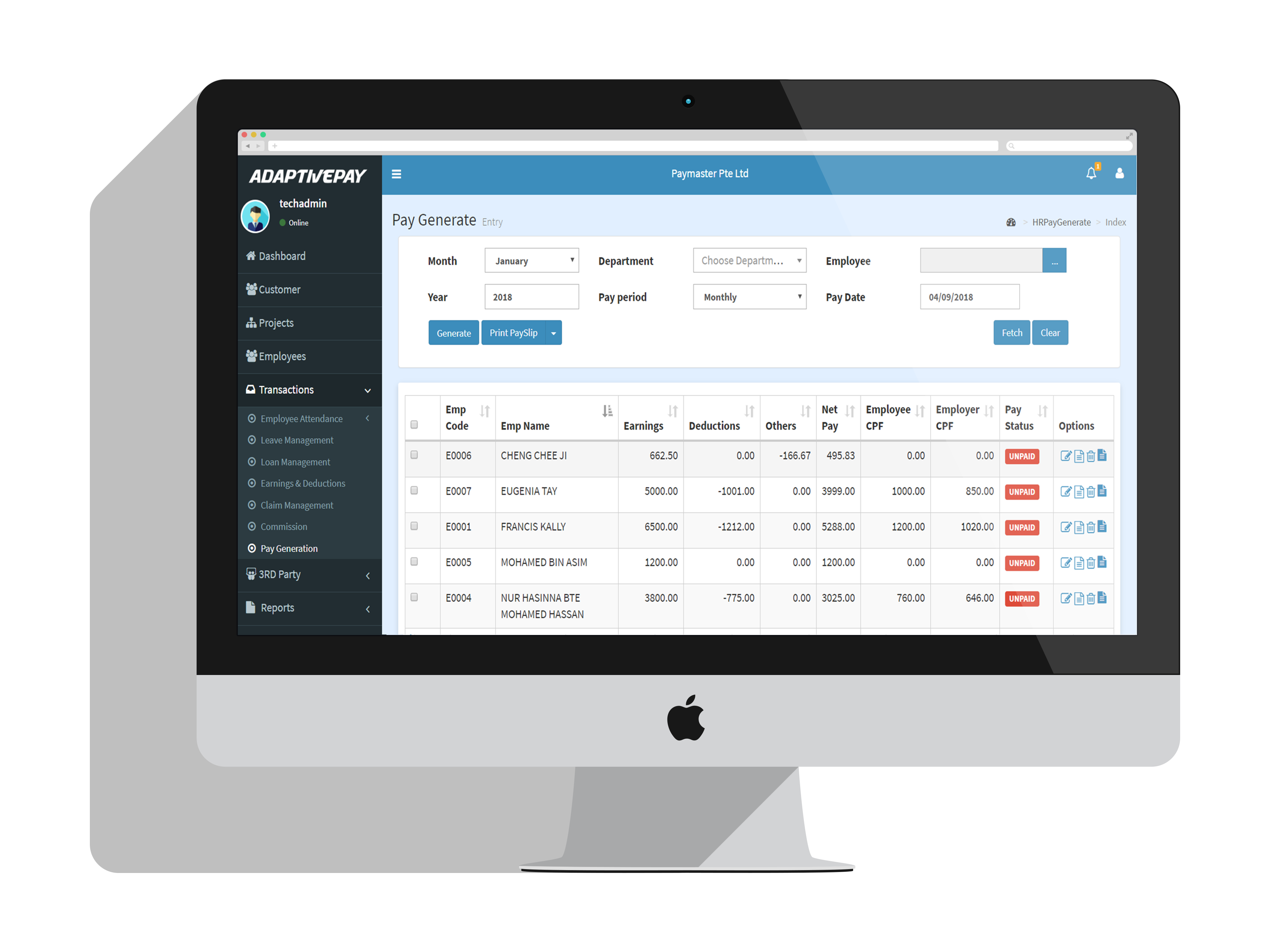

Our robust payroll processing engine handles complex payroll calculations with ease and accuracy.The seamless integration of our payroll engine to the other modules like the leave,claims,attendance etc. makes it a complete and all-inclusive payroll solution.The employee self-service feature of our payroll software allows the employees to take care of many of the HR related tasks that saves time and effort.

We , being an IRAS listed vendor ,our payroll management system is up-to-date with the changing policies, changes in taxation formats and rates so that the compliance risks are minimized.The complexities involved in tax calculations is simplified by the automation of tax calculations and IRAS filing . The system automatically takes the information needed for the tax form from the employee database.

The system is highly flexible in allowing to configure employee specific payroll components such as basic salary, allowances , deductions etc. The CPF computations are automated and is deducted along with Funds like SINDA,CDAC etc. The linking with leave and attendance module helps in auto calculation of the overtime wages for the employee.The claims module integration allows for the claims amount to be reflected in the monthly pay for the employee .

Finally the system calculates the monthly pay of the employee and is presented as an itemized pay slip for the month. The pay-slips may be autogenerated for all employees concurrently using a single click and sent via email or may be printed.For employees using the mobile app, once the pay slip is generated a notification is sent and the employees can view the payslip on their mobile phone using the app.

Payroll

Continually network virtual strategic theme areas vis-a-vis ubiquitous potentialities. Holisticly negotiate focused e-tailers without premium solutions.

Products

Payroll refers to the process by which employees receive their salary. Functions involve balancing and reconciling payroll data and depositing and reporting taxes.